About us

OPERATİONAL

DEPARTMENT

Operational Department is engaged in settlement of all types of transactions, card personalization, support for card accounts and dispute resolution. Among independent divisions of the Department “Call Center”, which provides services 7 days and 24 hours may be noted.

Development

DEPARTMENT

The department performs the development, upgrade and update of software, as well as support and maintenance of software developed earlier. Specialists of department develop software both for the Company's own products, and for its partners including banks, payment aggregators, insurance companies, etc.

SECURİTY

DEPARTMENT

Security Department deals with issues of safety and security of our company and has all the facilities to ensure a high degree of protection. The department employs highly qualified specialists on both, physical and logical security. In addition, services on fraud prevention and detection take a priority within the company.

STRATEGIC DEVELOPMENT AND MARKETİNG DEPARTMENT

Department of Strategic Development and Marketing implements plans for the development and strategy of our company, provides professional support to the banks for certification. In addition, the department is working hard to develop a variety of card products for the retail trade sector and consumers.

İT

Department

The Department of Information Technology is the “backbone” of our company and all our activities are mainly concentrated around this department. The introduction of the latest achievements of technology, as well as the newest technologies associated with this department. It’s separately to be mentioned a division of Computer Programming which is engaged with software integration and development of various mobile applications.

CALL

CENTER

Our Call Center is an effective tool in satisfying not only requirements but staying ahead of customer expectations. Through integration with the company’s business processes we improve the quality of customer interactions.

Recent Projects

We owe our success to our people who are committed to their work and work with full responsibility, applying innovative technologies, being the best experts in their field and analyzing new opportunities for profitable growth. We have created our brand values which represent the future of the company. With these values we were able to build a strong foundation for the company and to focus in the right direction. Our mission and strategy unite our intentions and beliefs. Our mission is a promise to provide the best of our services and emphasizes who we are.

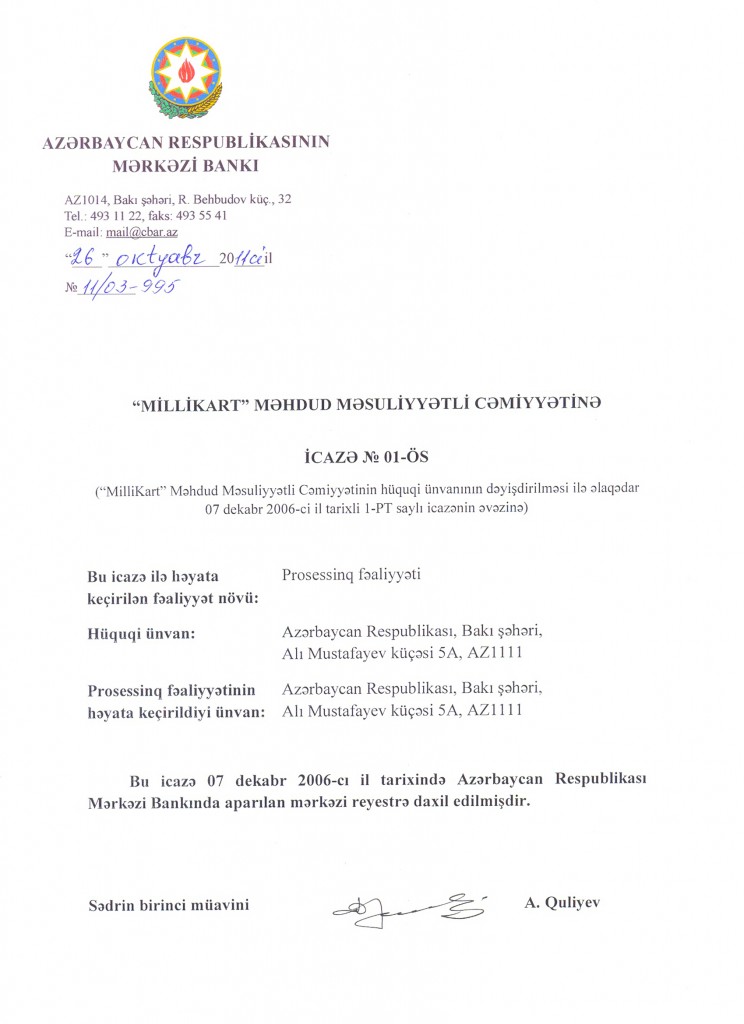

Company history: We began our activity as a card processing center. Eventually, the company was transformed into a limited liability company with a stable shareholder structure consisting of 18 banks, among which the European Bank for Reconstruction and Development is there.

Corporate culture: Corporate culture for us is a key factor determining the success and stability of our company. It binds us together, it increases our loyalty to the company, enhances our productivity. We are united into one cohesive system of general ideas, values and attitudes, norms and management practices shared by all members of the company, as well as reflecting and differentiating our company. Our company is separate ‘personality’ for us with its own features and characteristics. Our entire team wants to see it thriving and standing on its own feet.

Working

We believe that any business like a car – by itself it will only move downhill. We believe in the collective mind, but also the value of intellectual identity for us is immutable. We argue that one of the worst ways to utilize the time is to do the work that no one wants.

Resting

We believe that rest and work are inseparable, and the incoherent rest is worse tiring work. We know that the power must be in the brain and muscles as well. Therefore, we focus on meaningful weekends and sport.

OJSC “Azer Turk Bank” was founded in 1995, May 25th. Shareholding structure of Bank was formed in the following way in 2004, December 29th: State Committee on Property Issues of Azerbaijan Republic (75.00%), Ziraat Bank of Turkish Republic (12,37 %), OJSC AzRe Reinsurance (6.55%), OJSC Insurance Company “Qala Hayat” (5.00%), Ziraat Bank International (1.08%).

The Bank was established and functioned as the “Capital Investment Bank” (CI Bank). In 1996, the Bank established OJSC “Azerbaijan Industrial Insurance” with 100% of shares. The Bank has received a sign of quality TSE-İSO-EN 9000 which is a reliable and important indicator of the bank’s work in accordance with the international ISO quality system. In 2004 Bank established LLC “Azerbaijan Industrial Leasing” with 100% of shares. In 2005, the title of “Capital Investment Bank” (CI Bank) was changed to OJSC “Azerbaijan Industrial Bank”. The Bank participates in the structure of shareholders of MilliKart LLC with 10% stake of shares. Along with Bank’s head office there is 10 branches of the Bank operating.

In its activity Bank Standard follows the principles of professionalism, reliability, responsibility, quality and high standards of corporate culture.uccessfully functioning since 1993 is one of the largest commercial banks of Azerbaijan. “AtaBank” is the hi-tech universal bank rending full complex of services to corporate and private clients.The Bank is among the most reliable financial structures of Azerbaijan. The main strategy of development of activities of the Bank is built on development of corporate and retail banking based on granting of credits to clients belonging to full spectrum of competitive, hi-tech bank products and services.

DemirBank having already 26 summer history and a wide experience is one of leading banks of the country. The bank has been created as the first commercial bank in the country on October, 6th 1989. Known as Azerdemiryolbank it successfully functioned and has reached many heights. Since October, 16th of 2009 year the Bank will continue the activity as DemirBank.

Parabank is one of the oldest banks and was founded in 1991. Bank became official dealer of Western Union in Azerbaijan and managed to settle this payment system in 26 Banks and 140 points of “Azerpost”. Today bank has 16 licensed branches of which 8 are located in regions. There are also 2 new branches which are without license yet.

Bank was founded and licensed from Central Bank for performing banking operations in 1993, June 30th.

“Turan” Commercial Bank was founded according to the license of National Bank (# 60 ), dated to 12.06.1992 and license of Central Bank ( # 115) dated to 30.12.1992 passed re-registration and was permitted to carry out all kind of bank operations in national and foreign currencies.

The statutory meeting of shareholders was held on 27 May 1992 and the Commercial Bank “MBANK” was established. The Commercial Bank “MBANK” was transformed into an Open Joint-Stock Company following the decision of its founders on 27 July 1992. The National Bank of Azerbaijan provided the Bank with the banking license on 27 July 1992.

Xalq Bank has been registered at National Bank of Azerbaijan (License number 246 issued on December 27, 2004) and started banking activities. At the present, Xalq Bank increased its charter capital to 211.6 mln.

OJSC Zaminbank was established on November 16, 1992 based on the license N15 issued by Central Bank of Azerbaijan Republic and the bank was authorised to carry out all types of bank operations.

38 branches and 17 bank branches cover almost the entire territory of the Republic. Besides certain executive structures there exists collegial divisons for risk control. There was also formed special collegial bodies with purpose of managing assets (ALKO) and liabilities (LIKO) and currently they are successfully operating.

Currently Zaminbank is a member of Azerbaijan Banks Association, Baku Inter-banks Currency Exchange, Fund of Assistance ot Entrepreneurship under the Ministry of Economical Development, SWIFT and Visa International systems. Joining the Mortgage Fund of National Bank, in 2007 Zaminbank started lending mortgage loans.